Introduction to E-Invoice SaaS Solution Malaysia

In the contemporary business landscape, efficiency and speed are paramount, particularly in invoicing processes. An e-invoice SaaS solution Malaysia represents an innovative approach that streamlines the invoicing workflow, offering significant advantages over traditional methods. Historically, many small and medium-sized enterprises (SMEs) and larger enterprises in Malaysia have relied on conventional invoicing practices, which often involve substantial manual input, paper-based documentation, and potential errors that can disrupt cash flow and operational efficiency.

Traditional invoicing methods, although familiar to many businesses, can be cumbersome and time-consuming. The reliance on physical invoices demands extensive administrative efforts for creation, dispatch, and record-keeping. Moreover, these practices can lead to discrepancies and delays in payment processes, ultimately hindering financial performance. Recognizing these challenges, businesses are increasingly adopting e-invoice SaaS solutions, which leverage cloud technology to provide a more efficient and reliable method for generating, sending, and managing invoices.

E-invoicing operates by automating several aspects of the invoice lifecycle. Through a SaaS (Software as a Service) model, businesses can access the e-invoice platform from anywhere, ensuring flexibility and ease of access. The solution not only facilitates the rapid generation of invoices but also allows for integration with other business systems, such as accounting software and enterprise resource planning (ERP) systems. This leads to enhanced accuracy and real-time tracking of financial transactions. In Malaysia, the government has been promoting e-invoicing as part of its digital economy agenda, further driving its adoption among enterprises seeking to improve their invoicing processes.

As businesses in Malaysia transition to an e-invoice SaaS solution, they can expect to experience significant operational efficiencies and reduced costs, ultimately leading to improved financial management and cash flow visibility. Understanding these benefits is essential for any business aiming to compete effectively in today’s dynamic market environment.

Streamlining Invoicing Processes with E-Invoice SaaS Solution Malaysia

The introduction of an e-invoice SaaS solution in Malaysia has transformed the invoicing landscape for businesses of various sizes. By automating core invoicing processes, these solutions significantly reduce the time and resources needed to create, dispatch, and oversee invoices. Instead of engaging in labor-intensive manual processes that often lead to human errors, companies can leverage technology to streamline their financial operations efficiently.

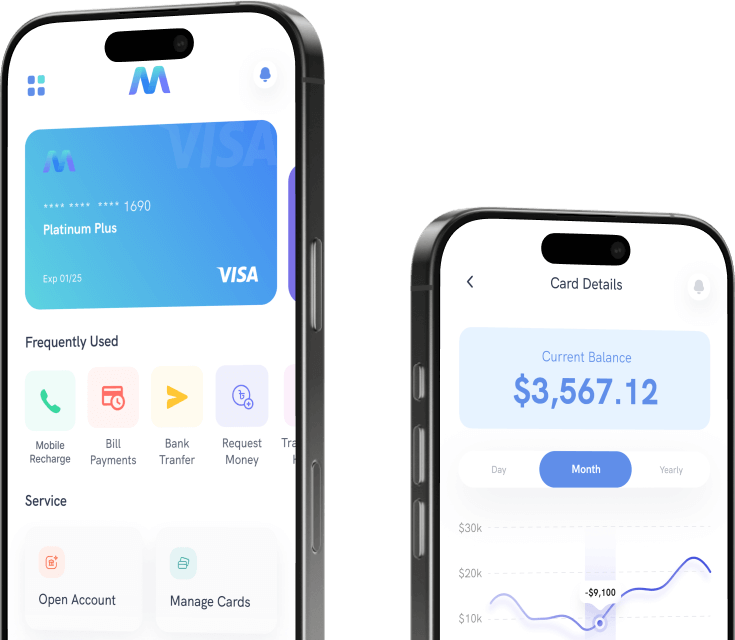

One of the most significant advantages of adopting an e-invoice SaaS solution is the capability to generate invoices swiftly and accurately. With intuitive interface designs, users can create professional-looking invoices in a matter of minutes, minimizing the burden on accounting staff. Furthermore, these systems facilitate the automatic insertion of relevant information, such as client details and services provided, which not only saves time but also diminishes the likelihood of inaccuracies that can occur with manual entry.

Moreover, the automated dispatch feature inherent in an e-invoice SaaS solution ensures that invoices reach clients promptly via email or integrated platforms. This expedites the entire billing cycle, allowing businesses to reduce the accounts receivable turnover period drastically. As payment processing is a critical element in maintaining cash flow, speedier invoice dispatch translates to quicker payments from clients, ultimately enhancing overall business health.

Additionally, e-invoice SaaS solutions provide comprehensive tracking and management functionalities. Business owners can monitor the status of sent invoices in real time, easily identifying which invoices are outstanding or overdue. This increased visibility not only aids in effective cash flow management but also equips businesses with the tools needed to follow up on payments consistently, thereby further streamlining financial processes. In conclusion, by automating invoicing methods, an e-invoice SaaS solution in Malaysia significantly enhances operational efficiency and accuracy.

Real-Time Tracking and Management

The adoption of an e-invoice SaaS solution in Malaysia provides businesses with enhanced visibility and control over their financial transactions through real-time tracking features. This innovative technology allows companies to monitor the status of their invoices at any given moment, enabling immediate access to critical financial data. By utilizing cloud-based systems, businesses can ensure that they are always updated with their invoice’s progress from issuance to payment.

One of the primary benefits of real-time tracking is improved cash flow management. Companies can effectively assess when payments are due, allowing for better forecasting of income and identification of potential cash shortages. With an e-invoice SaaS solution, users can easily track which invoices have been paid, are overdue, or are in the approval process. This facilitates timely follow-ups and reduces the risk of delayed payments, thereby enhancing overall organizational efficiency.

The visibility provided by real-time tracking extends beyond just cash flow; it also enhances strategic decision-making. With accurate insights into payment cycles, businesses can identify trends in customer payment behavior, enabling them to make informed decisions regarding their credit policies and sales strategies. Furthermore, transparency in invoicing fosters stronger relationships with clients, as they can also view the statuses of their invoices, minimizing disputes and enhancing collaboration.

Moreover, the ability to monitor invoice statuses in real-time contributes to a streamlined workflow. Employees can focus on other critical areas rather than spending time on manual tracking processes. An e-invoice SaaS solution automates several functions of the invoicing cycle, thus empowering businesses to allocate resources more effectively and achieve greater operational agility.

Cost-Effectiveness of E-Invoice SaaS Solution Malaysia

Implementing an e-invoice SaaS solution in Malaysia presents significant cost benefits, particularly for small and medium-sized enterprises (SMEs) and larger organizations. One of the most notable advantages is the reduction in paper usage. Traditional invoicing methods often involve printing, mailing, and storing physical documents, incurring substantial costs. By transitioning to an e-invoice setup, companies can eliminate these expenses, as electronic invoices require no physical materials and have minimal storage costs.

Moreover, adopting an e-invoice SaaS solution helps in decreasing operational costs. The automation of the invoicing process reduces the time spent on manual data entry and minimizes human errors, leading to fewer discrepancies and the need for costly rectifications. Such efficiency allows employees to focus on more strategic tasks rather than administrative ones, potentially increasing overall productivity and profitability. This operational streamlining is particularly beneficial for SMEs that often operate with limited resources.

Additionally, the value of improved efficiency in invoice processing cannot be overstated. Faster invoice turnaround times mean that businesses can recognize cash flow improvements and better manage their finances. With instant access to invoices and financial data, organizations can make informed decisions more swiftly, further enhancing their competitive edge. By leveraging an e-invoice SaaS solution in Malaysia, businesses can also promptly respond to market changes and customer needs, which is essential in today’s fast-paced economy.

The cost-effectiveness of integrating an e-invoice SaaS solution goes beyond mere savings on paper and operational efficiency; it also fosters a more agile financial environment. By minimizing costs and maximizing efficiency, companies can redirect resources into growth initiatives, paving the way for long-term sustainability and success. Thus, the financial benefits of adopting such technological solutions are profound and should be a key consideration for any organization looking to thrive in the competitive landscape of Malaysia.

Improved Accuracy and Reduction of Errors with E-Invoice SaaS Solution Malaysia

In the business landscape of Malaysia, leveraging an e-invoice SaaS solution significantly enhances accuracy and minimizes errors related to invoicing. Traditional invoicing methods are often prone to human mistakes, which can lead to discrepancies, delayed payments, and strained relationships with clients and suppliers. By implementing an automated e-invoicing system, businesses can streamline their invoicing processes, ensuring that each invoice is generated with precision.

Automation is a cornerstone of e-invoice SaaS solutions. These platforms typically utilize advanced algorithms and integrated databases to fetch relevant data, which reduces the chances of errors that arise from manual data input. For example, invoice amounts, customer details, and item descriptions are automatically pulled from existing records, thereby ensuring that the information included in every invoice is accurate and up-to-date. This level of accuracy fosters greater trust and transparency between businesses and their clients, supporting stronger business relationships.

Moreover, the reduction of errors in invoicing also has significant implications for financial audits. Auditors rely on accurate financial records to assess a company’s fiscal health. Inaccuracies in invoicing can lead to potential audit findings, causing complications and driving up costs related to compliance. An e-invoice SaaS solution mitigates this risk by ensuring that all invoicing data is not only accurate but readily accessible, allowing for efficient audits and smoother financial operations.

Adopting an e-invoice SaaS solution in Malaysia is, therefore, instrumental in generating reliable invoices, which enhances reporting accuracy. This improved precision not only streamlines business processes but also promotes a reputable and efficient image to clients, ultimately contributing to overall business success.

Enhanced Security Features

In today’s digital landscape, the security of financial transactions and sensitive data is of paramount importance for businesses in Malaysia. An e-invoice SaaS solution is designed to provide enhanced security features that protect companies from unauthorized access and cyber threats. These robust measures contribute significantly to safeguarding critical financial information, thereby fostering trust between businesses and their clients.

One of the primary security mechanisms employed in e-invoice SaaS solutions is data encryption. This technology ensures that all transmitted information is encoded and can only be deciphered by authorized individuals or systems. When businesses use an e-invoice SaaS solution in Malaysia, sensitive data such as payment details and client information are encrypted, minimizing the risk of interception by malicious entities. Thus, data encryption serves as a frontline defense against potential cyber threats.

Additionally, user authentication plays a crucial role in maintaining the integrity of an e-invoice system. Implementing multi-factor authentication (MFA) requires users to verify their identity through multiple methods, such as passwords combined with authentication apps or biometric data. This extra layer of security ensures that even if a password is compromised, unauthorized users cannot gain access to the sensitive data stored within the e-invoice SaaS solution. For Malaysian businesses, particularly those that handle large volumes of transactions, such robust authentication measures are essential for mitigating risks.

Furthermore, reputable e-invoice SaaS providers often implement regular security audits and compliance checks to ensure adherence to industry standards. By taking advantage of these features, Malaysian businesses not only protect their financial information but also demonstrate their commitment to maintaining high security standards, thereby reinforcing customer confidence and enhancing overall business reputation.

Integration Capabilities of E-Invoice SaaS Solution Malaysia

The integration capabilities of an e-invoice SaaS solution in Malaysia serve as a critical component in streamlining business operations. By enabling seamless integration with various business management systems, such as accounting, Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM) platforms, organizations can achieve a higher level of operational efficiency. This interconnectedness not only simplifies processes but also ensures that data is consistently accurate and easily accessible across different departments.

One of the key advantages of integrating an e-invoice SaaS solution with accounting software is the reduction of manual data entry. Traditionally, businesses often faced challenges in reconciling invoices with their accounting records, leading to errors and discrepancies. However, with an integrated e-invoice system, invoices can be automatically uploaded and matched with corresponding transactions, significantly minimizing the risk of human error. This automated process saves valuable time, allowing finance teams to focus on strategic activities rather than rote administrative tasks.

Furthermore, the integration with ERP systems facilitates real-time tracking of inventory and resources. Businesses can efficiently manage their procurement and logistics functions through synchronized invoicing and inventory updates. This results in informed decision-making, as organizations have access to accurate data regarding stock levels and incoming orders. Similarly, by connecting an e-invoice solution with CRM platforms, companies can enhance customer interactions by ensuring billing processes are timely and accurate, thus fostering better relations and increasing customer satisfaction.

In conclusion, the integration capabilities of e-invoice SaaS solutions in Malaysia not only enhance operational efficiency but also promote data coherence across various business functions. This synergy ultimately contributes to a streamlined workflow, enabling businesses to operate more effectively in a competitive market.

Compliance and Regulatory Advantages

One of the primary benefits of utilizing an e-invoice SaaS solution in Malaysia is the assurance of compliance with local laws and regulations governing electronic invoicing and digital payments. The Malaysian government has been at the forefront of integrating digital technologies into business practices, encouraging organizations to adopt e-invoicing as part of their financial operations. E-invoice SaaS solutions are designed with compliance features that align with Malaysian regulations, such as the Goods and Services Tax (GST) regulations and the requirements set forth by the Ministry of Finance.

By leveraging an e-invoice SaaS solution, businesses can easily generate and manage invoices that meet the necessary legal standards. These platforms often include automated updates to reflect any changes in compliance requirements, thus reducing the burden on businesses to stay informed about evolving regulations. Furthermore, these solutions also facilitate secure and auditable transaction records, which are imperative in maintaining compliance during financial reviews or audits.

Additionally, organizations utilizing e-invoice SaaS solutions can significantly mitigate legal risks associated with invoicing errors or non-compliance. Manual invoicing is prone to mistakes that could lead to penalties, disputes, or tax issues. In contrast, automated e-invoices reduce human error, ensuring accurate billing practices. Moreover, many solutions include built-in validation checks that prevent common invoicing mistakes from occurring in the first place.

The adoption of an e-invoice SaaS solution not only streamlines the invoicing process but also positions businesses to operate with greater efficiency and credibility. Thus, ensuring that all invoices are compliant with Malaysian regulations not only fulfills legal obligations but also enhances a company’s reputation in the marketplace. Ultimately, the regulatory advantages offered by e-invoice SaaS solutions represent a significant step forward in achieving operational excellence and maintaining fiscal integrity in Malaysia.

Conclusion: The Future of Invoicing with E-Invoice SaaS Solution Malaysia

As businesses in Malaysia continue to navigate the complexities of modern financial management, adopting an e-invoice SaaS solution has proven to be a transformative strategy. This technology not only enhances operational efficiency but also facilitates compliance with regulatory requirements, a crucial factor for financial stability in the region. The key benefits of utilizing an e-invoice SaaS solution in Malaysia include automated invoicing processes, reduction of human errors, and significant savings in time and resources. This positions organizations to focus more on their core business activities rather than getting bogged down by administrative tasks.

The adaptability of e-invoice solutions also aligns seamlessly with the growth of digital transactions in Malaysia, enhancing the overall customer experience. Businesses can deliver invoices faster, allowing for quicker payment cycles, which are particularly beneficial for small and medium enterprises (SMEs) that often struggle with cash flow. Furthermore, the cloud-based nature of these solutions assures secure data storage and accessibility, reducing the risk of loss associated with traditional paperwork.

With digital transformation being a key driver in business success, integrating e-invoice SaaS solutions is gradually becoming a necessity rather than a luxury. Malaysian enterprises that embrace this technology are not only optimizing their internal processes but are also contributing to a more streamlined and effective invoicing ecosystem. The future of business transactions in Malaysia looks promising as e-invoice solutions pave the way for innovation and increased competitiveness. By investing in these digital solutions, organizations set themselves up for long-term success in an increasingly digital marketplace.